A number of years in the past, after a university talking gig in Michigan, I caught a red-eye to Miami. After passing baggage declare, I relaxed on a bench with my baggage at my toes.

Earlier than I knew it, I’d handed out. And after I awoke, my backpack was noticeably lighter.

The thief had taken my laptop computer, pockets, even my charger — and surprisingly — left my backpack. I gave the police my laptop computer’s serial quantity and instantly canceled all my playing cards. Sigh.

Fortunately, Miami’s Best really used my laptop computer’s serial quantity to trace it, rescue it, and arrest the thief.

However since I’d canceled my bank cards, my troubles have been simply getting began.

Netflix, Amazon, and numerous different companies began banging at my digital door. I need to’ve learn the phrase “There’s an issue along with your cost technique” two dozen occasions.

Crappy conditions like this are why card lock is a revelation.

And it’s not only for use towards criminals, both. Card locks have tons of on a regular basis makes use of that may prevent huge complications.

What’s Forward:

What’s card lock?

Card lock is a function that allows you to freeze your bank card with out canceling it.

Which will sound like a semantic distinction, nevertheless it’s really a reasonably large deal, for one very particular cause: card lock helps you to maintain your previous bank card quantity.

Locking as a substitute of canceling completely modifications the sport.

Along with your card on lock, you not have to fret about somebody racking up expenses in your misplaced or stolen bank card. With the cardboard lock on, the cardboard will get declined for each new transaction, so any attainable thief will assume it’s been canceled and toss it within the trash.

Even when it’s simply sitting behind the bar, you don’t even have to return to the bar to get it. You may order a brand new, similar card with the identical account quantity to reach ASAP (one which most likely swipes higher than your previous one, too) and ask the bar to chop up your previous one.

How does locking your bank card work?

Bank card firms need you to make use of card lock, as a result of a misplaced or stolen card is a good greater legal responsibility for them than it’s for you.

Chase was the unique pioneer of card lock, having launched it in September of 2018. For that, I’ll allow them to do the honors of exhibiting the way it normally works.

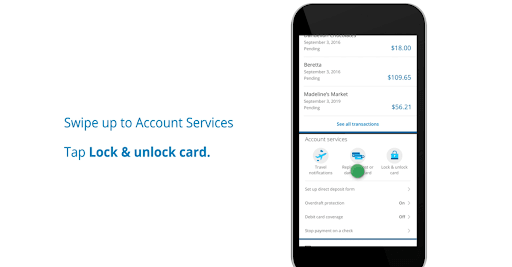

From the Chase Cellular® app, all you must do is scroll all the way down to your card, faucet on it to see current exercise, and scroll down from there to see Account Companies.

Then, faucet the massive ol’ padlock on the proper, and Bob’s your uncle.

Locking your card doesn’t block all transactions — simply new ones. That’s a vital distinction as a result of it signifies that your recurring funds to your utilities suppliers, landlord, and so forth., gained’t be interrupted.

It mainly simply prevents unhealthy guys from occurring a buying spree till you possibly can both discover or destroy your card.

Does card lock work for debit playing cards, too?

Yup! Most debit playing cards supply a card lock function. It would be best to check with your financial institution for particular particulars.

Are there nonetheless occasions you’d need to cancel your card?

Sure. Listed below are three circumstances when freezing is probably not sufficient to save lots of your card data:

- Your bank card data has leaked on-line. In case your bank card data has been leaked on-line, it’s attainable that thieves will try to make use of it a number of occasions earlier than it expires. That’s a great time to chop your losses and get a very new card quantity.

- Your card is within the palms of somebody you mistrust. Equally, in case your sketchy landlord or seedy ex nonetheless has your card data, and particularly in the event that they know you froze it, they could simply be ready for it to unfreeze. Time to cancel.

- You’re nonetheless getting fraudulent expenses after you unfreeze. This ties into bullets one and two, however if you happen to unfreeze your card and nonetheless get peppered with fraudulent expenses, that’s undoubtedly an indication that your card data is compromised.